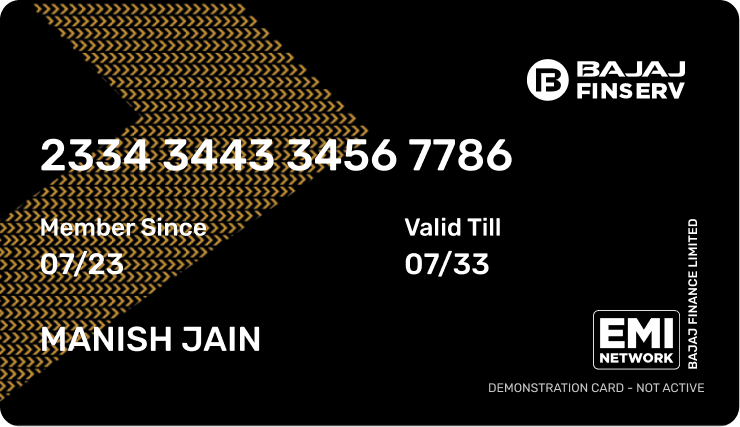

Insta EMI Card

The Bajaj Finserv Insta EMI Card is a financing solution that allows you to shop for 1 million+ products on No Cost EMIs. With the Insta EMI Card, you get a pre-approved loan limit of up to Rs. 2 lakh that you can use at 1.5 lakh + online and offline partner stores across 4000+ cities. You also get to choose a flexible repayment tenure of up to 24 months for your purchase.

Features and benefits of our Insta EMI Card

01:03

01:03

Insta EMI Card - An overview

-

Accepted at 1.5 lakh+ stores

The card is accepted across 4,000 large and small cities. Wherever you are, walk into our partner stores and shop on EMIs.

-

Zero down payment

During festive seasons, we run zero down payment schemes where you do not have to pay anything at the time of purchase.

-

Lower-EMI special schemes

You can opt for our special EMI schemes that offer a longer repayment tenure and reduce your monthly EMI.

-

Everything on EMIs

Shop for daily groceries, electronics, fitness equipment, home appliances, furniture and more, and split the bills into Easy EMIs.

-

Flexible repayment tenures

Convert your purchases into monthly instalments and pay back over 1 to 60 months

-

End-to-end digital process

The entire application process is online. It takes less than 10 minutes to complete.

Eligibility criteria and documents required for Bajaj Finserv Insta EMI Card

Anyone can get an Insta EMI Card as long as you meet the basic criteria mentioned below. If you meet the criteria, you will need a set of documents to complete your application process.

Eligibility criteria

- Nationality: Indian

- Age: 21 years to 65 years

- Income: You must have a regular source of income

- Credit score: As per Bajaj Finance risk policies

Documents required

- PAN Card

- Aadhaar Card number for KYC confirmation

- Address proof

How to apply for the Insta EMI Card

00:45

00:45

Insta EMI Card Applicable fees and charges

Type of fee |

Applicable charges |

EMI Network Card fee |

₹530 (inclusive of applicable taxes) |

| *Additional fees and charges will apply when utilising the EMI Network Card to avail of loans. | |

Frequently asked questions

The Bajaj Finserv Insta EMI Card, also known as the EMI Network Card, lets you convert all your purchases into No Cost EMIs. You can use it to shop for the latest products online and offline.

If you are between 21 years and 65 years of age, you can apply for the Bajaj Finserv Insta EMI Card.

No physical documents are required to get the Bajaj Finserv Insta EMI Card. You just need the following details:

- PAN Card details

- Aadhaar Card number for KYC confirmation

- Bank account number and IFSC code for e-mandate registration

To register for your e-mandate, you need to:

- Share your bank account number and IFSC code

- Verify all the details entered by you

- Submit OTP for validation purposes

By registering for your e-mandate, you will:

- Never miss on your EMI payments with the auto-debit feature

- Manage your loans in an efficient manner

You can avail of finance to shop using the Bajaj Finserv Insta EMI Card at any of our online and offline partner stores on No Cost EMIs. All you need to do is provide your card details and authenticate your transaction with an OTP sent to your registered mobile number.

The Insta EMI Card is issued digitally and gets activated online instantly. Therefore, you will not receive a physical card; simply access it on the Bajaj Finserv app.

You can view your card details on the Bajaj Finserv app.

Follow the below-mentioned steps:

- Download the app

- Enter your registered mobile number

- Submit the OTP sent to your mobile number

- Click on the ‘EMI’ icon

- Enter your date of birth

- View your Insta EMI Card

With the Bajaj Finserv app, you can:

- Access your Insta EMI Card and all related details

- Get exclusive offers